Polkadot (DOT) Review: The MOAB (Mother of All Blockchains)

WikiBit 2022-08-28 21:56

WikiBit 2022-08-28 21:56In fact, from 2016 onwards, Polkadot has built an incredibly reputable ecosystem of top-notch developers, architects and project leaders, has designed a sophisticated future roadmap and has experienced exponential growth, allowing it to secure a spot within the Top 10 most valuable cryptocurrencies in 2021.

Polkadot's initial development and Proof of Concept (PoC) design first emerged over 4 years ago, when the project was still relatively unknown to crypto enthusiasts and institutional investors, but it has since proven to be one to watch. Polkadot, in fact, has built an extremely reputable ecosystem of top-tier developers, architects, and project leaders since 2016, has created a sophisticated future roadmap, and has experienced exponential growth, allowing it to secure a spot among the Top 10 most valuable cryptocurrencies in 2021.

Polkadot has clearly taken over the cryptocurrency markets and shows no signs of slowing down anytime soon. Polkadot's momentum is likely to continue as the project nears the end of its roadmap with the implementation of Parachains, the Rococo Testnet, and the impending upgrades to its native Cross-Chain Message Passing (XCMP) system.

Polkadot has been described in a variety of ways, including the tired label of a “Ethereum killer” cryptocurrency. While its founder insists that Polkadot is not a competitor to Ethereum, a closer look at Polkadot reveals that it is not only a serious competitor to Ethereum, but also a cryptocurrency that has the potential to completely transform the cryptocurrency world.

Origins of Polkadot

Polkadot's history begins with Ethereum, specifically with one of Ethereum's co-founders, Dr. Gavin Wood (PhD in Software Engineering). Dr. Wood has over 20 years of expertise as a software developer, both inside and outside of the cryptocurrency industry.

He wrote Ethereum's Yellow Paper and created the first functioning version of Ethereum. Dr. Wood is likely best known for developing Solidity, the computer language used to create smart contracts on Ethereum.

Dr. Wood resigned as Ethereum's CTO and core developer in January 2016. The precise reasons for his resignation differ (including among Dr. Wood himself), but may be summed up as his dissatisfaction with the delayed development of Ethereum 2.0.

Later that year, Dr. Wood began working on a new cryptocurrency that would “deliver on the promises that Ethereum could not.” By the end of 2016, the first draft of the Polkadot whitepaper had been completed.

The DOT Cryptocurrency ICO

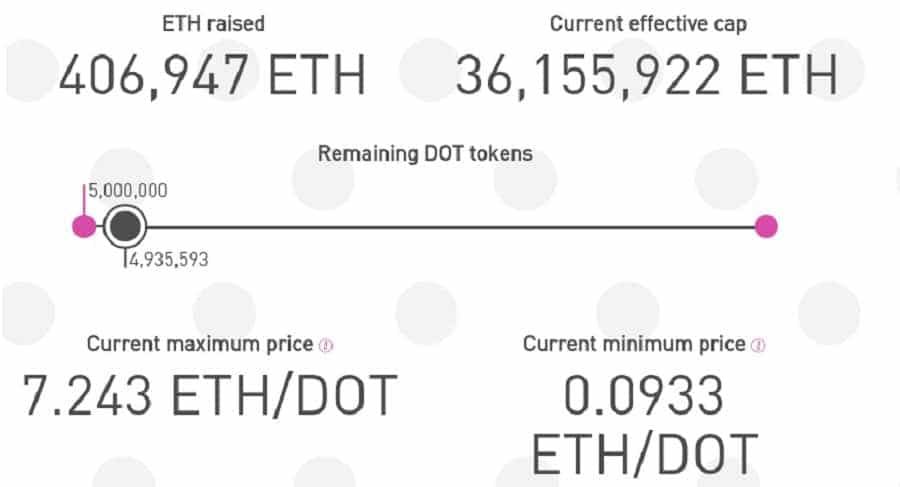

Polkadot's DOT cryptocurrency's initial coin offering is something that many veterans in the cryptocurrency world, and definitely the Polkadot team, remember clearly. In October 2017, the DOT ICO raised over 145 million USD in Ethereum.

Half of DOT's initial total supply of 10 million was sold to public and private investors in two waves (2.25 million and 2.75 million, respectively). For these investment rounds, the price per DOT token was 28.80$USD.

In less than two weeks, nearly 90 million USD of the ICO money were permanently frozen owing to an exploit of a vulnerability in Polkadot's multisig wallet code. One week after the attack, the Polkadot team confirmed that they still had enough resources to complete Polkadot and continued development despite the loss of finances. Despite efforts to recover the assets, more than 500 000 ETH remain frozen.

The post-ICO debacle marked the team's wallets being hacked for the second time due to a coding weakness. The first hack occurred in July of 2017 and saw over 33 million USD in Ethereum drained until the attack was stopped by the White Hat Group, a benevolent group of hackers. In both situations, the Polkadot team issued follow-up literature outlining the attacks and how to avoid them in the future.

Polkadot held another private investment round in January 2019 in an attempt to make up for the lost (frozen) cash from the DOT ICO. 500 000 DOT were sold at a premium of 120$USD each DOT, raising more than $60 million USD.

A third private investment round was held in July of this year, selling little under 350 000 DOT tokens at a price of 125$USD apiece. This generated an additional 43 million USD. The entire fundraising for Polkadot's DOT cryptocurrency was more than $250 million USD (with 90 million still frozen).

What is Polkadot?

Polkadot is a cryptocurrency initiative that aims to power the internet's decentralized future (Web 3.0). It is interoperable with other blockchains both inside and outside of cryptocurrency, it enables the creation of smart contracts and new blockchains (and tokens), it allows blockchains to exchange information, it is upgradeable (no hard forks! ), and the protocol is governed by those who own DOT, Polkadot's native cryptocurrency.

Polkadot is a project of the Web3 Foundation, a non-profit organization situated in Switzerland's Crypto Valley (Zug). The Polkadot network is being developed and maintained by the Web3 Foundation in collaboration with Parity Technologies of the United Kingdom.

Dr. Gavin Wood is a co-founder of both the Web3 Foundation and Parity Technologies, and hence the primary developer of the Polkadot network. Polkadot is created with Substrate, a blockchain development platform created by Parity Technologies.

How does Polkadot work?

Polkadot is without a doubt one of the most difficult cryptocurrencies to understand. While we would ordinarily say that we can explain it to you in layman's terms, there is no way to explain Polkadot without eventually falling into a schism of technical language. Some Polkadot network components have a whole series of articles dedicated to explaining them. In an ironic twist, the entire Polkadot network is accessible through a simple browser plug-in known as Polkadot.js.

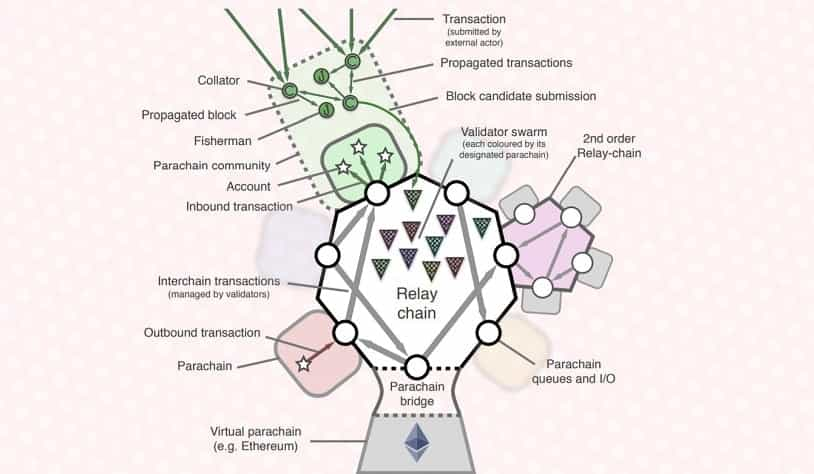

Polkadot is a blockchain ecosystem at a glance. The Polkadot blockchain's core is known as the Relay Chain. Parachains are blockchains that are linked to the Relay Chain. These parachains are capable of having their own tokens, consensus methods, and even governance systems.

As previously stated, Substrate is used to construct the Relay Chain. Any Substrate-based parachains can readily join to the Relay Chain. To connect to the Relay Chain, any “external” blockchain, such as Bitcoin or Ethereum, requires a bridge.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

- Token conversion

- Exchange rate conversion

- Calculation for foreign exchange purchasing

0.00