Crypto Braces for Unprecedented Turbulence: The Impact of a Recession

WikiBit 2023-05-18 10:50

WikiBit 2023-05-18 10:50This article analyzes the impact of an economic recession on the cryptocurrency market, considering the influence of the Fed's monetary policies and interest rates. It explores the role of cryptocurrencies as a safe haven, the importance of stablecoins, and the effects of interest rates on DeFi platforms. Additionally, it examines how institutional investors may affect crypto market volatility during a recession.

The cryptocurrency market, known for its inherent volatility, is preparing to face a new test: the potential consequences of an economic downturn.

The intricate interplay between global economic trends, monetary policies, and the digital asset market is poised to shape the future of the crypto ecosystem.

The Role of the Federal Reserve

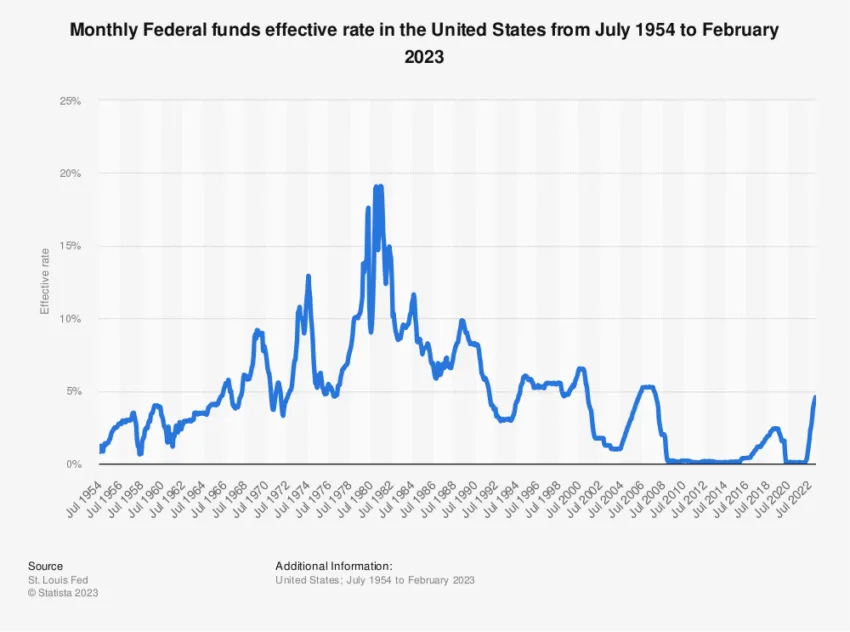

The US Federal Reserve, as the central banking system of the United States, holds significant influence over the economic landscape. Its monetary policies, particularly those related to interest rates, have a profound effect on both the broader economy and the cryptocurrency market.

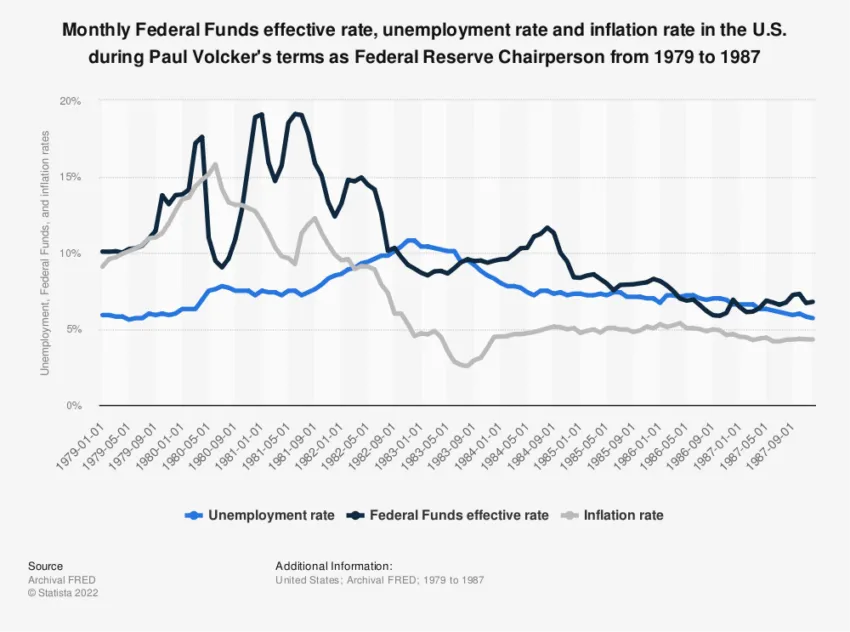

During times of recession, the Federal Reserve typically pursues a strategy of lowering interest rates to boost economic activity, promoting borrowing and investment. However, the timing and duration of a recession present inherent uncertainties that can complicate the implementation of such policies.

Amid the profound effects of the Great Recession, the US economy experienced a significant downturn due to the mortgage crisis. To mitigate the repercussions, the Federal Reserve took decisive action by reducing interest rates, providing relief to distressed mortgages and reinvigorating economic activity. As we delve into the impact of these strategies, an intriguing question arises: what implications might they hold for the dynamic crypto market?

The Impact of a Recession on Crypto

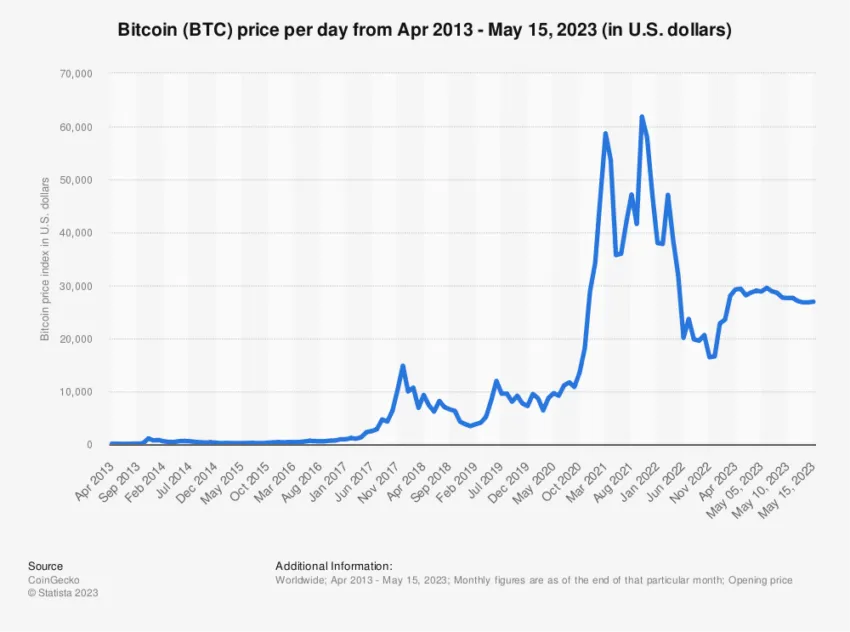

Regarded as the “digital gold,” Bitcoin has emerged as a possible safeguard against volatility in traditional financial markets. Consequently, the repercussions of an economic recession on the cryptocurrency market have become a subject of great fascination and conjecture.

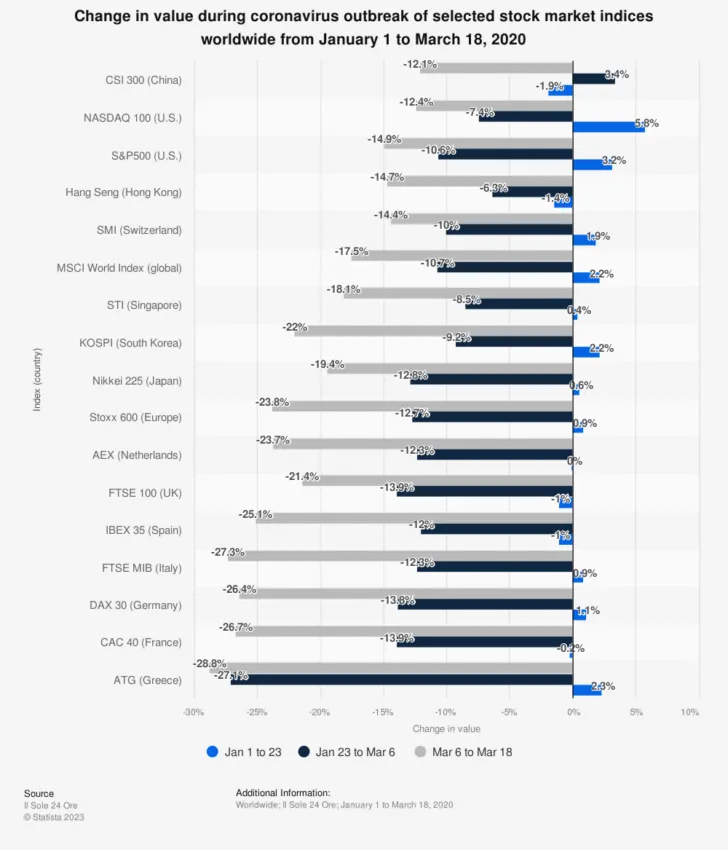

In the midst of an economic downturn, conventional assets often experience a decline in value, as observed during the Great Recession. Nevertheless, the crypto market's reaction to such a downturn may vary due to its decentralized structure and detachment from traditional financial systems.

Unlike traditional assets, cryptocurrencies such as Bitcoin could present an alternative investment avenue during a recession. Bitcoin's decentralized, borderless, and non-governmental characteristics have the potential to make it an appealing store of value amidst turmoil in traditional markets.

Bitcoin has demonstrated sporadic instances of a negative correlation with conventional markets, implying that it may offer some degree of diversification during market downturns. Nevertheless, it is crucial to acknowledge that the classification of cryptocurrencies as safe haven assets remains a topic of discussion among industry experts.

In the initial phases of the COVID-19 pandemic, Bitcoin and other cryptocurrencies encountered substantial price declines in conjunction with traditional markets. This occurrence prompted inquiries into the dependability of cryptocurrencies as safe haven assets during times of crisis.

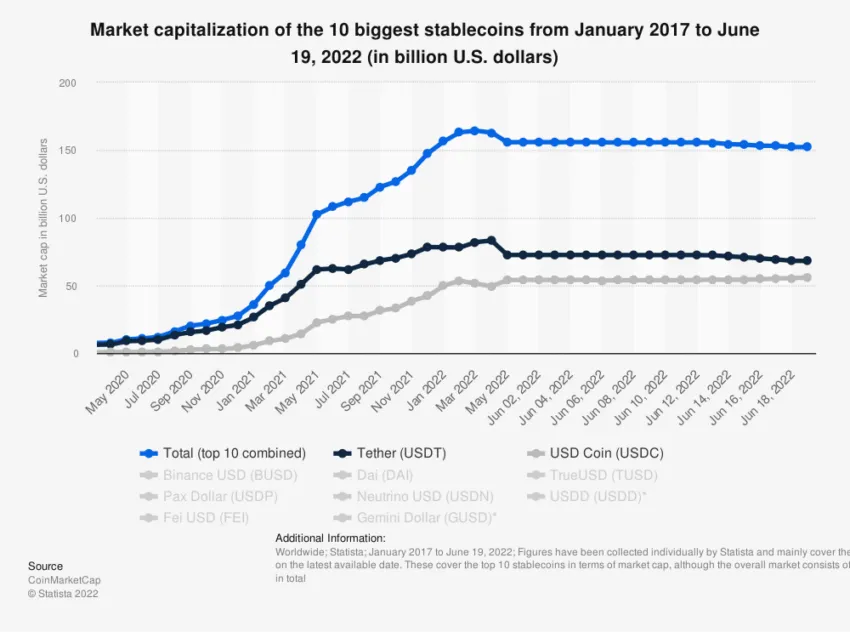

During an economic downturn, stablecoins, which are cryptocurrencies pegged to traditional assets like the US dollar, may assume a crucial role. These digital assets are specifically designed to retain a stable value, potentially appealing to investors looking to safeguard their capital amid periods of economic turbulence.

Notably, Tether (USDT) and USD Coin (USDC) are two widely adopted stablecoins backed by the US dollar. These stablecoins offer investors an avenue to mitigate the volatility associated with traditional cryptocurrencies while still participating in the digital asset market.

During an economic downturn, there is a potential rise in the demand for stablecoins as investors look to manage risk while actively engaging in the digital economy.

The Intersection of Interest Rates

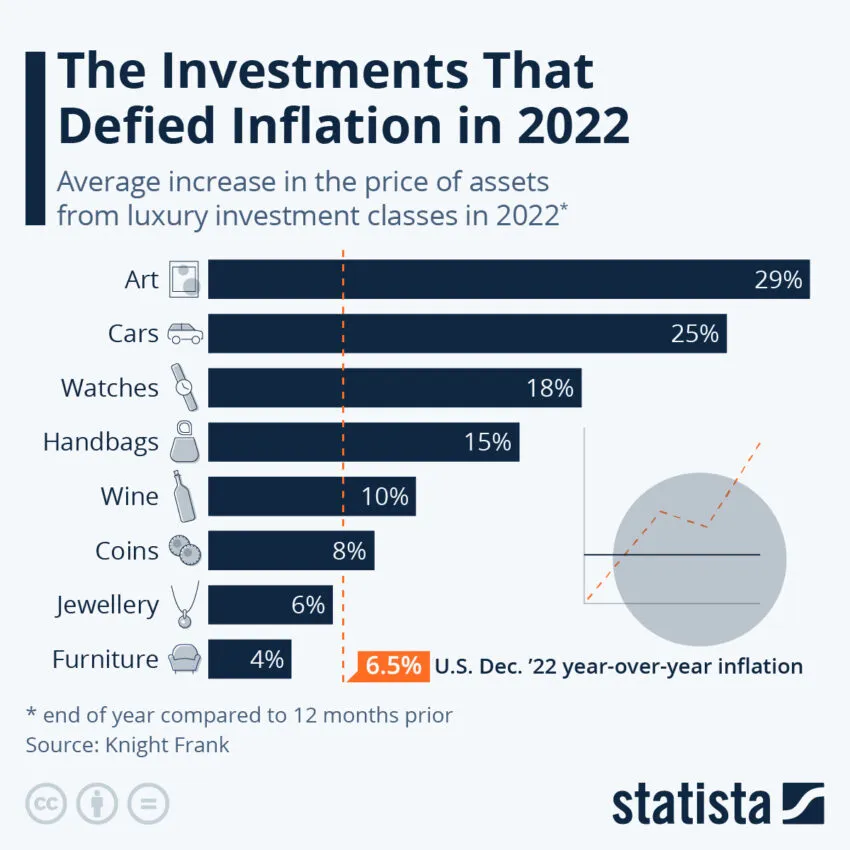

Interest rates have a notable impact on the crypto market, manifesting in various ways. In a low-interest-rate environment, such as during a recession, traditional investments like bonds often yield lower returns, prompting investors to seek out riskier assets like cryptocurrencies.

Conversely, elevated interest rates can raise borrowing costs, potentially diminishing liquidity within the crypto market. Investors may opt for safer and higher-yielding investment opportunities instead of venturing into cryptocurrencies, considering the availability of more secure options.

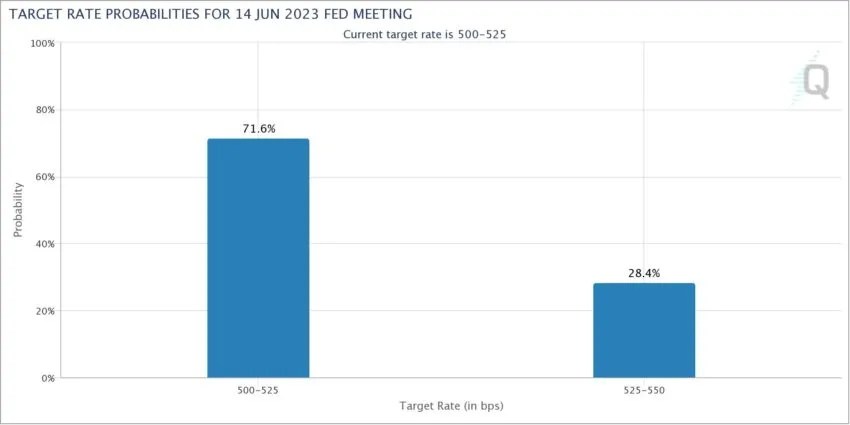

The crypto market keenly observes the impact of the Federal Reserve's interest rate decisions, which, in conjunction with other factors, significantly influence the market's trajectory.

The interplay between interest rates and investment in risky assets is evident in both traditional and crypto markets. When interest rates are low, the cost of borrowing decreases, providing investors with a more affordable means to finance their purchases of riskier assets, including cryptocurrencies.

Conversely, higher interest rates make safer assets like bonds more appealing. The certainty of returns offered by these assets can diminish the allure of riskier investments such as cryptocurrencies.

Changes in interest rates can have an impact on borrowing and lending platforms within the crypto market. These platforms provide opportunities for users to earn interest on their crypto holdings or access loans using their assets as collateral.

During periods of low interest rates, the interest rates offered by these platforms may become more enticing compared to traditional investment options. This can attract users who seek higher returns on their investments in a low-interest-rate environment.

Current Economic Indicators

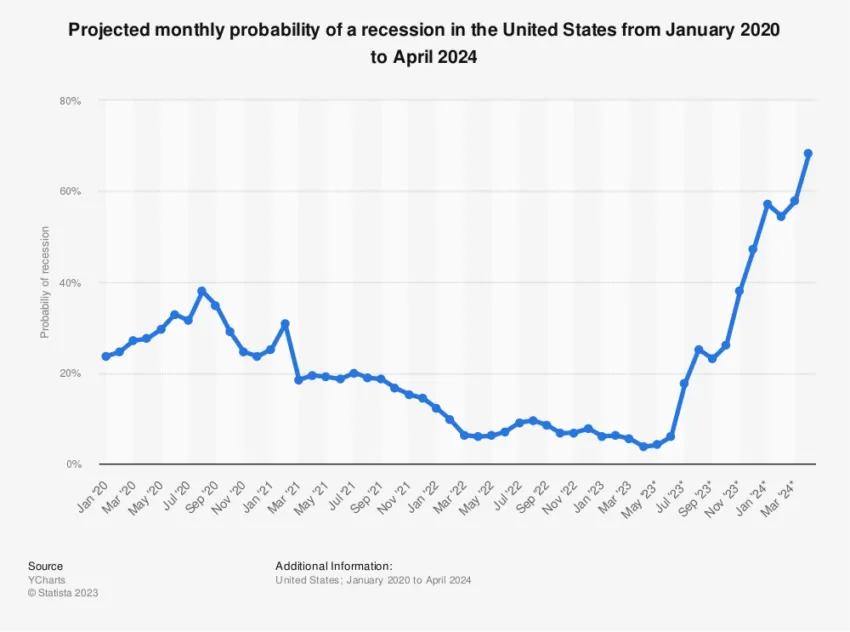

Recent economic indicators suggest possible adjustments in the Federal Reserve's monetary policy, with US Treasury Secretary Janet Yellen expressing urgency for timely fiscal measures in upcoming critical meetings.

These potential changes in policy direction raise concerns about the possibility of an impending recession, which could have significant ramifications for the crypto market.

The FedWatch Tool offered by the CME Group is a valuable resource for crypto investors, as it assesses the probability of Federal Reserve rate movements.

This tool enables market participants to evaluate the likelihood of changes in interest rates, which in turn influences the perceived appeal of crypto investments.

The involvement of institutional investors holds significant influence over the crypto market's response during a recession. This group, comprising hedge funds, pension funds, and endowments, has demonstrated growing interest in the crypto market.

The participation of institutional investors can contribute to stabilizing a downturn, given their typically longer-term investment outlook compared to retail investors. However, the risk-averse nature of institutional investors may also result in their retreat from the crypto market during a recession, potentially amplifying market volatility.

Crypto Navigates Uncertain Waters

The effect of a recession on the crypto market introduces a new frontier for investors, raising questions about the specific implications for cryptocurrencies. This period presents a mix of challenges and opportunities.

The resilience of the crypto market will undergo scrutiny during a recession, putting theories of cryptocurrencies as a hedge against traditional market instability to the test.

In this uncertain landscape, it is crucial for investors, regulators, and market participants to closely monitor economic indicators and policy decisions. The intricate relationship between the Federal Reserve's policies, the overall economic environment, and the crypto market will shape the future of digital assets during periods of economic turbulence.

Gaining a comprehensive understanding of the dynamics and potential strategies to mitigate risk and capitalize on opportunities is vital. This understanding will be instrumental in navigating the impact of a recession on the crypto market and beyond.

Disclaimer: In accordance with the Trust Project guidelines, this feature article provides insights and viewpoints from industry experts or individuals. WikiBIT is committed to transparent reporting; however, it should be noted that the opinions expressed in this article do not necessarily represent those of WikiBIT or its staff. Readers are advised to independently verify the information and seek professional advice before making any decisions based on the content provided.

Looking to stay informed on the latest developments in the world of cryptocurrencies? Look no further than WikiBIT, your one-stop resource for all things related to digital assets. With WikiBIT, you can access a wealth of up-to-date news on the hottest topics in the industry, as well as search for relevant trading firms and obtain key information such as their ratings, user reviews, and regulatory status.

In addition to these valuable features, WikiBIT also offers the latest market trends and insights on a variety of digital currencies, helping you to stay ahead of the curve and make informed trading decisions.

Download WikiBIT today and start taking advantage of all the benefits it has to offer. And always remember - when it comes to investing in cryptocurrencies, WikiBIT is here to help you navigate the risks and protect yourself from potential pitfalls.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiBit Exchange

- Token conversion

- Exchange rate conversion

- Calculation for foreign exchange purchasing

0.00